[This article is a selection from The Skyscraper Curse: And How Austrian Economists Predicted Every Major Economic Crisis of the Last Century.]

The 1960s and 70s were precarious times for the Austrian school. Ludwig von Mises was very old, retired, and would die in 1973 at the age of ninety-two. Friedrich Hayek was also retired and ensconced at the University of Salzburg in Austria from 1969 to 1977. He called his move to Salzburg a mistake. He had not worked on business cycles and monetary policy for many decades and his research interests at this time were very different. Henry Hazlitt retired from Newsweek in 1966 at the age of seventy-two. Murray Rothbard was a young man and was marginalized and isolated, with little institutional support. There were precious few other Austrian economists in the entire world, and the next generation of Austrian economists had not left graduate school or had not even entered graduate school.

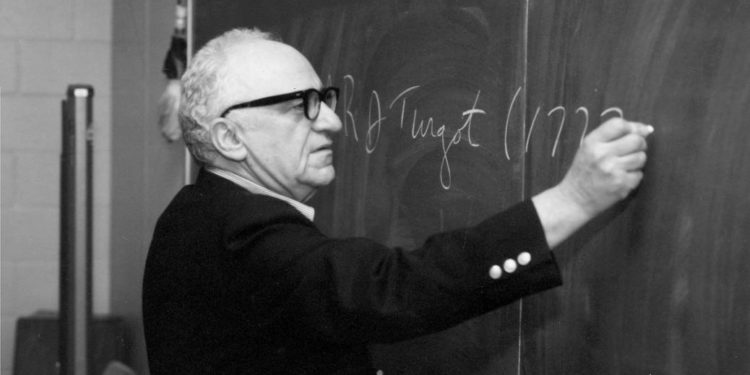

Mises at the age of eighty-nine continued to lecture during the critical 1968–70 period, and make public appearances. Some of his more important lectures included: “The Problems of Inflation” (April 3, 1968); “On Money” (April 3, 1969); “The Balance of Payments” (May 1, 1969); “A Seminar on Money” (November 8, 1969); “The Free Market Society” (February 21, 1970), where he discussed the problems arising from increasing the supply of money; and “Monetary Problems” (June 23, 1970), where he discussed why the return to the true gold standard was so important and essential for economic growth and stability and why the Bretton Woods system was so problematic. Sampling these lectures makes it obvious that Mises in his elder years was completely attuned to the monetary-policy problems and their potential consequences and was doing his best to alert others of the looming dangerous outcomes.

Henry Hazlitt was hardly retired either. After leaving Newsweek in the fall of 1966 he began writing for the Los Angeles Times, and between the fall of 1966 and June 1969 Hazlitt published 177 articles in the Times.1 Almost all of the articles discussed the dangers looming because of current monetary and fiscal policy. He clearly saw that the Bretton Woods gold standard was the core problem because it led to too much government spending and a loose monetary policy. For example, he wrote articles such as “Budget Out of Control” (February 12, 1967), “People Want Gold” (February 22, 1967), and “Currency Crisis Ahead” (March 29, 1967) in early 1967. In 1968 he wrote “What a Gold Reserve Is For” (February 3, 1968), “The Most Irresponsible Budget” (February 11, 1968), and “The Dollar Crisis: A Way Out” (March 17, 1968). Hazlitt wrote in 1969 on topics like “The Coming Monetary Collapse” (March 23, 1969), “Pretending That Paper Is Gold” (May 4, 1969), and “Good-Bye to the ‘New Economics’” (June 8, 1969). Hazlitt clearly saw the critical fault in the Bretton Woods System: that the US government would overspend — for example, spending on the Vietnam War, the space mission to the moon, and the War on Poverty — and pay for it by printing dollars. He clearly saw early on that the Bretton Woods–style gold standard would collapse, which it did in 1971.

Murray Rothbard was also keenly aware of what was happening to the US economy in the late 1960s. He published a small pamphlet on the subject of business cycles in 1969 — Economic Depressions: Their Cause and Cure. This was just prior to the end of the longest expansion in US history and the beginning of thirteen years of stagflation and depression. It is very similar to Mises’s book The Causes of the Economic Crisis published the year before the stock market crashed in 1929. Rothbard would continue writing about the looming crisis and the role of the Austrian business cycle theory:

In the sphere of economics the Nixon Administration had been highly touted among conservatives. It was supposed to herald a return to the free-market and a check upon galloping inflation through monetary restriction. Again, nothing has happened. The much publicized monetary tightening has been half-hearted at best, and provides no real test of the effectiveness of monetary policy. For the Administration has been doing precisely what its spokesmen had been deriding the Democrats for doing: trying to “fine-tune” the economy, trying to cut back ever so gently on inflation so as not to precipitate any recession. But it can’t be done. If restrictionist measures were ever sharp enough to check the inflationary boom, they would also be strong enough to generate a temporary recession.2

Rothbard continued his assault on Nixon’s economic policies:

The phenomenon of inflationary recession cannot be understood by Establishment economists, whether of the Keynesian or the Milton Friedman variety. Neither of these prominent groups has any tools to understand what is going on. Both Keynesians and Friedmanites see business cycles in a very simple-minded way; business fluctuations are basically considered inexplicable, causeless, due to arcane changes within the economy, although Friedman believes that these cycles can be aggravated by unwise monetary policies of government.3

In contrast, Rothbard was keenly aware of this political dilemma, the “inflationary recession,” because he attended some lectures by his then thesis advisor Dr. Arthur F. Burns4 at Columbia University in 1958. Rothbard recalled the incident with his professor and later chairman of the Federal Reserve:

I remember vividly a prophetic incident during the 1958 recession, when the phenomenon of inflation-during-recession hit the country for the first time. I attended a series of lectures by Dr. Arthur F. Burns, former head of the Council of Economic Advisers, now head of the Federal Reserve Board, and someone curiously beloved by many free-market adherents. I asked him what policies he would advocate if the inflationary recession continued. He assured me that it wouldn’t, that prices were soon leveling off, and the recession would soon be approaching an end; I conceded this, but pressed him to say what he would do in a future recession of this kind. “Then,” he said, “we would all have to resign.” It is high time that we all took Burns and his colleagues up on that promise.5

Rothbard is directly confronting the “new economists” and their beloved Phillips Curve analysis with the phenomenon we now call stagflation, which Rothbard called an “inflationary recession.”

Rothbard also attacked the Nixon administration’s labor guidelines and income policy. He correctly predicted that such policies would likely lead to wage and price controls, which they did the following year:

While we can firmly predict accelerating inflation, and dislocations stemming from direct controls, we cannot so readily predict whether the Nixonite expansionism will lead to a prompt business recovery. That is problematic; surely, in any case we cannot expect any sort of rampant boom in the stock market, which will inevitably be held back by interest rates which, despite the Administration propaganda, must remain high so long as inflation continues.6

Rothbard went on to show that Keynesian and Friedmanite economists cannot understand this phenomenon and have no way to address such problems. In contrast, he showed how Austrian economists can understand this phenomenon through price theory and capital theory and that they do have policy recommendations on how best to address the problems of stagflation. Interest rates must be raised in order to flush out malinvestments and price inflation from the economy.

F. A. Hayek was awarded the Nobel Prize in economics in 1974 for his work building on Mises’s writings on business cycle theory. Hayek had been working in isolation in Austria and concentrating on his research in entirely different directions for some years. However, when the crisis hit in the early 1970s he rushed back into action. Hayek’s7 first publication on this issue was put together by Sudha R. Shenoy, the daughter of the great Indian economist B. R. Shenoy. She seamlessly strung together materials from Hayek’s early writings on money and business cycles into a coherent monograph. To this 1972 book, Hayek contributed the essay “The Outlook for the 1970s: Open or Repressed Inflation?” He also published three monographs — Choice in Currency: A Way to Stop Inflation (1976), Denationalization of Money: The Argument Refined (1977), and Unemployment and Monetary Policy: Government as Generator of the “Business Cycle” (1979) — that sought to address the problem of the monetary crisis and economic depression.

The Austrians of the time were few but they turned out to be very vocal and correct about the threat of economic crisis. In fact their emphasis on raising interest rates and stopping the money printing might have been very influential in the form of the interest rate policy adopted by Fed chairman Paul Volcker (1979–87). It did cause a severe contraction, but it did end the monetary and price inflation and set the stage for a robust recovery.

It should also be noted that Dr. Ron Paul, an advocate of Austrian economics, decided in 1971 to run for a seat in the House of Representatives because Nixon had taken the United States off the gold standard. He has helped build a worldwide movement for Austrian economics. Also, the Cato Institute was founded in 1974 by Ed Crane, Murray Rothbard, and Charles Koch. The Cato Institute in 1982 published the monographs by F. A. Hayek, as well as The Case for Gold: A Minority Report of the U.S. Gold Commission, by Ron Paul and Lewis Lehrman.8 Finally, the Ludwig von Mises Institute was founded in 1982 by Llewellyn H. Rockwell, Jr.; its premier mission is to educate people about the benefits of a true gold standard as described in the Gold Commission’s minority report. The monetarist-packed US Gold Commission won the battle to maintain fiat money, but Ron Paul, the Cato Institute, the Mises Institute, and the Austrian school have all grown enormously in influence since then.

1. Jeffrey A. Tucker, Henry Hazlitt: A Giant of Liberty (Auburn, AL: Mises Institute, 1994).

2. Murray N. Rothbard, “Nixon’s Decisions,” Libertarian Forum 1, no. 8 (July 15, 1969): 1.

3. Ibid., p. 4.

4. Doug French, “Arthur Burns: The Ph.D. Standard Begins and the End of Independence,” in The Fed at One Hundred: A Critical Review on the Federal Reserve System, edited by David Howden and Joseph T. Salerno (Heidelberg, New York, London: Springer, 2014), pp. 91–102.

5. Murray N. Rothbard, “The Nixon Mess,” Libertarian Forum 2, no. 12 (June 15, 1970): 1–3.

6. Murray N. Rothbard, “Nixonite Socialism,” Libertarian Forum 3, no. 1 (January 1971): 1–2.

7. F. A. Hayek, “The Outlook for the 1970s: Open or Repressed Inflation?” in Tiger by the Tail: The Keynesian Legacy of Inflation, edited by Sudha R. Shenoy (Washington, DC: Cato Institute, 1972).

8. Ron Paul and Lewis Lehrman, The Case for Gold: A Minority Report of the U.S. Gold Commission (Washington, DC: Cato Institute, 1982), which was based on the research of Murray Rothbard.