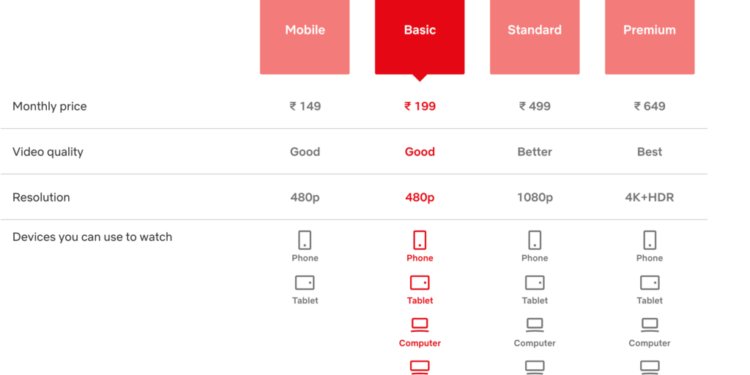

Netflix’s special new price drop for subscriptions is revolutionary as this is the first time Netflix has reduced its subscription prices. The monthly subscription price for the basic plan is now just for Rs. 199 from Rs. 499, the standard plan is for Rs. 499 from Rs. 649, the premium plan is for Rs. 649 from Rs. 799 for HDK and 4K streaming, and simultaneous watching up to 4 screens. The basic plan’s subscription price has dropped dramatically, and it’s now available on all types of devices (phone, tablet, computer, and TV) at a poor streaming resolution (480p), but only on one device at a time.

Image Source – Netflix

These discount prices do reflect Netflix’s desire to gain more customers. Let us understand the motivation behind these offer prices. Advertisement support for Indian cable television players is 100 percent. That’s why cable TV in India has low entry charges. Cable TV is comparatively expensive in other countries and is ad-free. Customers in India are still not willing to pay extra for content. Paying Rs. 499 a month for Netflix is a steal for some people. Others are less willing to pay that much. Both types of customers represent a missed opportunity for Netflix to increase its revenue.

Assume that if Netflix charges the reluctant customer somewhat less, its audience may grow. Close to what Netflix did, initially, they did not have a low-cost plan in India. As a result, to increase its market share in small towns, Netflix launched a mobile plan to reach the masses, draw more income, and aid to reshape its image. “We want to broaden the audience for Netflix, want to make it more accessible, and we know just how mobile-centric India has been,” said Ajay Arora, Director of Product Innovation at Netflix.

Image Source : Gizarena

The Rs. 199 mobile plan (480p), which is now for Rs. 149, prevents users from accessing the service from their computer screen or television. Now, Netflix wants to include those customers who were restricted only to mobile plans, to experience Netflix on other devices at the same price, as the mobile plan then was of the same value as it is today for the basic plan. As a result, this technique aims to persuade a mobile-oriented client who may be hesitant to spend more to join Netflix’s universal plan. This step will bring more opportunities for Netflix to grow in India, given the price-sensitive customer.

One interesting fact is that Netflix has reduced its prices in India but has contrastingly increased its prices in the United States, United Kingdom and recently in Argentina, Australia, Canada, Germany, and Ireland. So, do they get more if they pay more? Not necessarily. The more they pay for the plans in these countries, the less cost-effective it tends to be. Customers in the United States are getting less and less for their money.

With an increase in prices, it’s position has dropped to 27th place for library sizes. A profit-maximizing firm will price discriminate; if the profit from dividing the markets is more than the profit from merging the markets. Netflix is reducing its prices in countries with elastic demand and increasing its prices in countries with inelastic demand for it’s product. To some extent, a case of third-degree price discrimination based on location and economic status.

Image Source : Merazone

In 2021, Netflix has launched 40 originals in India. They are trying to provide as many hits as possible so that their customers do not shift to other services. Netflix had spent nearly Rs. 3,000 crores on content in India in 2019 & 2020. Netflix co-CEO Ted Sarandos stated that India demonstrates a tremendous opportunity for the business. Netflix is leaving no stone unturned to get the maximum benefit possible. Netflix has reduced it’s subscription prices in India, whereas it’s competitor Amazon Prime has increased its yearly subscription price. In the coming years, the OTT platform has a huge scope of growth. Netflix intends to invest more to gain more customers and eventually increase it’s market share in India.

Written by- Riya Kashyup

Edited by- Isha Mehrotra

The post The Happy new pricing strategy for Netflix- Lower prices for all devices appeared first on The Economic Transcript.