US auto giant Ford has become the latest of many auto companies to cease operations in India. The company had set up shop in the country in 1995, after a failed attempt in 1953 when they had to pull out (due to severe import restrictions). The country entered the Indian market as Mahindra Ford India Limited, which was a 50-50 joint venture with Mahindra and Mahindra Ltd. In September 2021, the company stated that it would stop all domestic manufacturing but would continue to export high-end cars to India. The company is the third US vehicle company to withdraw from the Indian market after General Motors and HarleyDavidson.

A number of factors led to the withdrawal of the multinational from the Indian market. Industry experts think that Ford misread the Indian market. They think Ford didn’t design an appropriate market penetration strategy as other car makers have, such as Hyundai and Maruti-Suzuki. The Indian car market is dominated by small cars, and has been for years. India is not a country of luxury or muscle cars like Monaco or Dubai. The average consumer looks for factors such as mileage and functionality, which companies like Ford and GM missed. They focused on engine power and performance, which are characteristics appreciated more in the United States. Hormazd Sorabjee, the editor of Autocar India, said the mindset of western manufacturers is different and that they don’t understand the cost structure required to succeed in the Indian market.

Another possible reason for stagnating sales was lack of variety. Ford focused on the Ikon for a while when the other car companies were introducing new models and iterations frequently. The company had accumulated losses of more than USD 2 billion over the last 10 years and a non-operating write-down of assets worth nearly $1 billion in 2019.

Source – Wikipedia

The macro situation hasn’t helped Ford either. There is a shortage of semi-conductors in the global market due to supply chain problems, which have been mainly caused by the COVID-19 pandemic. Demand for semi-conductor chips has gone up because people are working from home and need computers, while supply has been disrupted. A lot of auto makers like Maruti-Suzuki, Toyota, and Mahindra and Mahindra have reduced production because of component issues.

Global semiconductor supply estimates.

The withdrawal from the market will cost the company around $2 billion and will affect the livelihoods of around 4000 employees as it closes its plants in Gujarat and Tamil Nadu. This will hurt the economy, of course, and will increase unemployment, which is already a problem amidst the pandemic. The Indian passenger vehicle market has been in a slump for the last few years, and this has been exacerbated by the pandemic. Demand has slowed and showrooms and retail outlets have been closed for long periods of time.

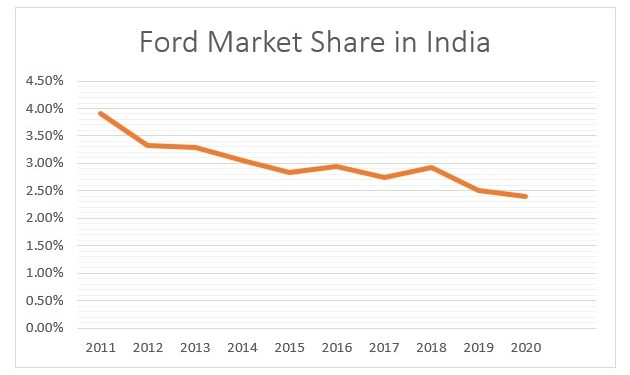

Source – Statista

Ford never had any significant presence in the Indian market, with most of the market share being dominated by Korean and Japanese carmakers. They did, however, sell two popular utility vehicles, the EcoSport and the Endeavour. While Ford’s withdrawal will not significantly affect competitor prospects, rivals can try to dominate the utility vehicle segment further.

Ford’s Gujarat plant. Source: The Indian Express

Ford has said that it will work on expanding its Business Solutions operations, which currently has over 11000 employees. This segment will focus on engineering and technology, and will provide opportunities for people from different fields, such as software developers, data scientists, engineers, and even finance specialists.

A consequence of the withdrawal of the company is that Ford dealers in India may face legal action from consumers. Indian consumer law makes dealers liable to consumers even after the parent manufacturer exits. It is expected that Ford will support the dealers and have something planned for the future so that dealers aren’t stuck in the event of consumer court cases against them.

The number of MNCs that have ceased operations in India in recent times have done so due to a combination of factors. They have had problems adjusting to the Indian market and designing products accordingly, as we read above. This is the reason Apple has a huge market in the US but a very limited market in India. The price point is simply too high for average consumers, who find cheaper alternatives in Chinese brands. Harley-Davidson stopped producing because of unfavorable import duties in India. The global scenario has not looked favorable, with supply and demand problems. MNCs of western nations like the ones mentioned above have had problems in the past due to high competition and established players in the Indian market. Companies need to reevaluate their marketing strategy if they wish to expand into such developing markets.

Written by: Aahan Tulshan

Edited by: Nanditha Menon

The post Ford’s Exit from India: Reasons and Implications appeared first on The Economic Transcript.